An award winning NBFC

Your Trusted and Safe Lending Partner

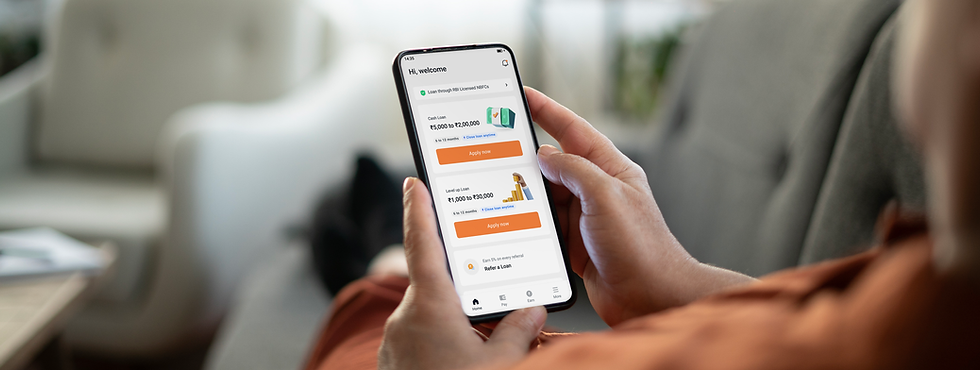

Loan Products

Cash Loan

Instant Digital Personal Loan in 5 minutes

Credit Amount : ₹5,000 - ₹2,00,000 (Disbursal Amount)

Monthly Interest Rate : From 2.4%

Repayment Tenure : 6 - 12 months

Processing Fee : 0 - 7.1%

Depending on the situation, additional documents such as Bank Statement may be required.

Level Up Loan

Instant Digital Personal Loan only with KYC

Credit Amount : ₹1,000 - ₹30,000 (Disbursal Amount)

Monthly Interest Rate : From 2.4%

Repayment Tenure : 6 - 12 months

Processing Fee : 0 - 8.4%

Repaying on time improves your credit score and gives you access to higher amounts

Loan Market

If the loan is not processed by True Credits,

then you can explore the loan products offered by below entities by directly visiting their website/app:

CASHe

Instant Digital Personal Loan in 10 minutes

Credit Amount : ₹1,000 - ₹4,00,000 (Disbursal Amount)

Monthly Interest Rate : From 2.25%

Repayment Tenure : 3, 6, 9, 10, 12 months

Processing Fee : 0 - 15%

Moneytap

Credit Amount : ₹2,000 - ₹5,00,000

Monthly Interest Rate : 0 - 36%

Minimum Repayment Tenure : 3 months

Maximum Repayment Tenure : 36 months

Processing Fee : 2%

Licensed

NBFC

100%

Safe & Secure

Ensure

Transparency

Completely

Digital

Why Trust True Balance

Why take a loan from

True Balance app?

No Paperwork

Quick and simple process without extensive paperwork

Quick Approval

We assess your application within minutes

No Bank Visits

100% online process for ease of use

Fast Disbursal

Claim your cash loan directly to your bank account, no waiting

Beware of Fraud

It has been reported in certain media segments that many individuals are falling prey to growing number of unauthorized digital lending platforms/Mobile Apps on the premise of getting quick loans. In the light of same, it is imperative for us to clarify that our company is not directly or indirectly associated with any such unauthorized lending apps. We further emphasize the fact that we follow best industry practices and comply with regulatory guidelines not only in letter but also in spirit in the line with the culture of the Company. Our Company is a sensitive and caring organization which empathizes with its customers and supports them during the times of need by offering them different financial products/ services suiting to their needs. In this context, please note that:

1. "True Balance" is a digital lending platform owned by Balancehero India Private Limited ("True Balance"). Balancehero India Private Limited is a company incorporated under the provision of Indian law and having its registered office at Gurugram, Haryana, which, is a RBI authorized Prepaid Payments Instruments issuing entity.

2. True Credits Private Limited ("True Credits"), a subsidiary of Balancehero India Private Limited is a Non- Banking Financial Company (NBFC-ND-NSI) duly registered with Reserve Bank of India ("RBI") having its registered office at Gurugram. True Credits was granted certificate of registration to commence/ carry on the business of non-banking financial institutions by RBI.

3. Both the companies do not hold direct/indirect investment from China and compliant with applicable FDI Policy. It is also clarified that both the companies have no relation with any unauthorized/ illegal apps recently reported in media.

4. True Credits adhere to its interest rate policy, Fair Practices Code and other regulatory guidelines issued in this regard in letter and spirit.

5. True Credits Private Limited is transparent in its dealing with customers. It conveys all applicable interest rate, terms and conditions and other charges to the loan products offered by it in an upfront manner transparently.

6. Applicable terms and conditions, Sanction Letter and Loan Agreement (as the case may be) shared with customer at the applicable stage and the same is also made available on the True Balance App which borrower can access at any time.

7. True Credits and its collection agents follow strict code of conduct prescribed for collection of dues. True Credits or its authorized agents never resort to make unsolicited calls to customers' or their contacts for the purpose of collection or follow any unethical/ illegal means of collection. True Credits has "Zero Tolerance" on violation of its code of conduct by its personnel and authorized collection agents.

8. A copy of Certificate of Registration to commence/ carry on the business of non-banking financial institutions (NBFC) dated October 4, 2019 as issued by RBI along with other necessary details are placed on the website of True Credits (www.truecredits.in).

9. True Credits Private Limited is having a valid Certificate of Registration dated October 14, 2019 issued by the Reserve Bank of India under section 45-IA of the Reserve Bank of India Act, 1934. However, the RBl does not accept any responsibility or guarantee about the present position as to the financial soundness of the company or for the correctness of any of the statements or representations made or opinions expressed by the company and for repayment of deposits/discharge of the liabilities by the company.

10. In case you observe any deviation, please highlight the same to us at info@truecredits.in.

Team True Credits and True Balance